The Sydney Morning Herald’s 9th October Headline Reads:

ASX enjoys best week since December 2011.

Yet just a few weeks ago the media was causing panic about falling markets, concerns with China’s slowing economy and the sluggish US jobs. With anything the media loves to focus on the short term and as investors we need to continue to be vigilant and focus on the longer term trends rather than short term fluctuations that are outside anyone’s control.

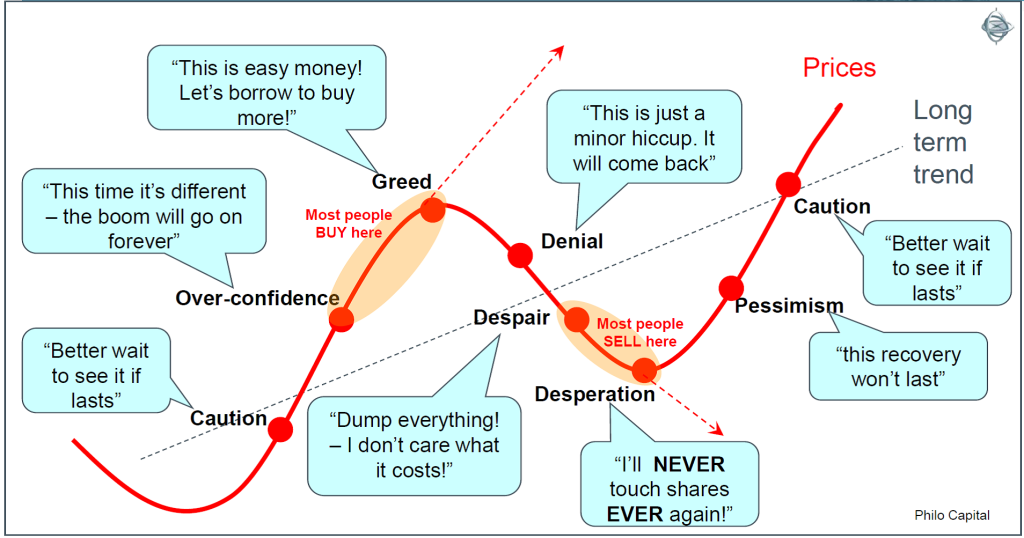

As investor one of the most difficult things is to detach our emotions when thinking about our money. Somehow they seem hardwired together and as we learn and become more experienced we know it is true but sometimes still find it hard.

The interesting thing is that as markets dip, experienced investors take the opportunity to buy at discounts while speculators exit positions as they worry about short term losses. Our Investment Beliefs Document reminds us of some the fundamental things I continue to re enforce with my clients. At the risk of sounding like a broken record, allowing our emotions to control our investment decisions usually leads us to disappointment and despair.

Markets are usually volatile and when we go through long periods of time without market volatility, that makes me more nervous. There is a good article from Chris Cuff (ex Colonial Investment Manager) from August 2013 that repeats the sames story of investor and our emotional roller coaster. Take a look here http://cuffelinks.com.au/investing-against-the-herd-part-1-resisting-emotion/

Have a great week and lets see what happens on Melbourne cup day and the RBA decision – more short term ammunition for people to play with, but over the long term investors time frame its all just insignificant noise as markets continue their upward trend.