Most investors would rather forget the last 6 months as some of the healthy returns from the last 5 years have been swiftly wiped away.

Looking back over the last 5 years we can see both the rises and falls have quite volatile but since the middle of last year, when the market nearly reached 6000, the fall to today’s level has been quite swift. Will the recovery be as swift? I’m unsure, but if the market continues to perform as it has done over the last 5 years, now is not a time to retreat to cash but its a matter of hanging on for the ride.

When markets begin to behave in this manner there are opportunities and risks to be aware of.

1) For people who are in retirement and drawing down an income, the risk is that you are forced to redeem the capital part of your investment in order to receive income to live off.

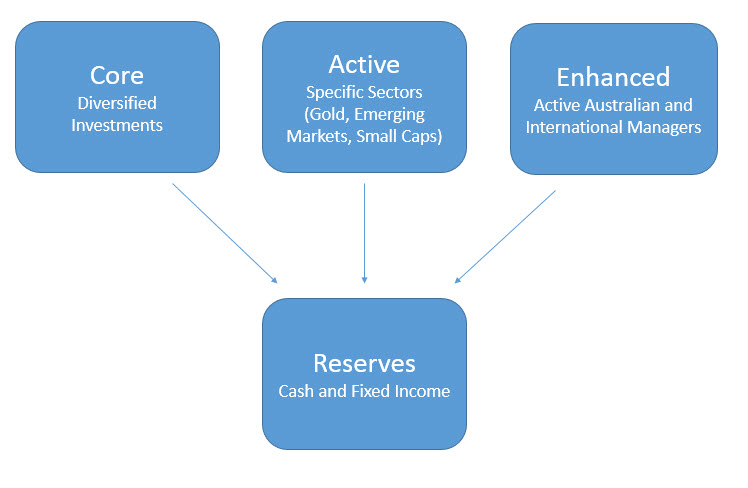

The strategies that I recommend provide a cash reserve and in many cases all the income that is generated from the investments, also tops up the cash reserves during the year. This provides a cash buffer for a period of 4 years or more year. This allows the part of the investment that has fallen with the market time to recover, while drawing from the cash reserves to meet your lifestyle.

Once the values recover, the cash reserve can be topped up with a lump sum if necessary to ensure the reserves are ready for when they are next needed. Because there is no way to predict when markets fall or by how much, an effective reserves strategy is crucial to preserving wealth and stopping fear from taking over and bailing out of the markets.

As uninspiring as it is to look at your overall balance falling, its important to understand that as long as you draw from the reserves, the capital in the top growth buckets (above) will have time to recover. This takes the emotion out of investing and prevents bad investor behaviour from affecting your long term investment results.

2) For investors with the ability to contribute, either from savings or from employer superannuation contributions, this presents a once in cycle ( 5-10 yrs) opportunity to purchase at a discount. Now is the time to get excited about investing because companies are selling at over 15% off their recent prices. The difficulty is to know if the market has continued its correction or how much further it could decline before recovering. Could it drop some more? It really won’t matter in the long term but there is something you can do.

The best way to counter this concern is to break up any capital you might have into monthly contributions. This strategy is called dollar cost averaging and you can see from the example here, that although only $12,000 was invested the total return over the period was $2054, or just over 17%. The original investment of $13.55 is only a 3.67% return compared to the price of $14.05 a year later but the dollar cost averaging strategy added over 13% through a disciplined approach and not worrying about trying to pick (guess) the bottom – which almost never happens.

Investors understand that to gain better than cash returns plus inflation, there is some investment risk that needs to be taken. This risk is not whether they will lose their money or keep it – it is more about excepting the level of volatility they experience along the way. Share markets are volatile by nature and they reward long term patience. Investors with capital and time on their side should use opportunities such as these to buy for long term growth. Those drawing down from their investments will need to ensure that there is sufficient liquidity to maintain daily living, which is what a reserves strategy should aim to achieve.

Ongoing advice and a trusted relationship is important and we are here to discuss any concerns you have. The fact remains, if you are worried or not sleeping at night then you are probably doing something with your money that we need to talk about!

Comment below if you like…