Today I received some news that shocked me and made me sick to my stomach. In September last year I met a young couple with a family who wanted to get their financial situation in order but sadly that will never happen now. At 38, the young man and father of 3 sadly passed away from a heart attack last week on his way home from the gym

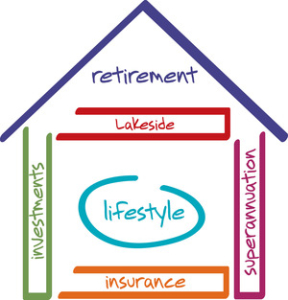

They were like most of us at this age, struggling to get ahead. They were running a business and trying to balance their time between bringing in the money and spending time together as a family. They knew they wanted a better life for themselves and for their children and had big dreams and goals. They knew however, that their financial house was not in order and planned to come back and see me to get the important things like their investments and personal insurances in place.

One of saddest things about someone dying so young is all of life’s opportunities that they miss. He will never get the opportunity to see his 3 young children grow into men, nor spend another night out with loving wife. For me, I think about all the future dreams they shared with me that will never come true now. I feel a deep level of sadness, because like many Australians, they were under insured and it’s only when a tragic event like this brings the realisation to reality.

And it wasn’t because they were ignorant to the need or didn’t believe in the need for life insurance, it was just because they thought they had more time to organise it. Time is a limited and extremely precious resource yet many of us we treat time as if it is an everlasting commodity.

However it is on days like this that my resolve is strengthened and I know that if I was delivering a cheque to this family, to pay for all the future promises they had made to each other and their children that there would be no questions about the time it took to sit down and sort out their financial affairs or the small cost of providing financial certainty.

After 15 years as a financial planner, I do struggle to understand why people feel it so important to insure their cars and homes the day they take possession but use time and money as excuses for not protecting what is most important, themselves.

Maybe it’s because we don’t like to think that we could die prematurely or have some illness or accident that affects us for the rest of our lives. One of Australians leading insurers, TAL paid our nearly $1 Billion in claims last year and nearly as many claims were paid to people under 55yr as over.

| *Age at claim | % of total claims |

| Up to Age 35 | 12.4 |

| 26-45 | 14.2 |

| 46-55 | 21.9 |

| 55-65 | 23.5 |

| Over 65 | 28.0 |

If you are a mother or father and have assets to protect or if you have a family that you have made future financial promises to, for dreams and goals, let today serve as notice that time waits for no person. If your loved one didn’t come home tonight, what impact would that have on your financial situation and when will you do something about it?